Disclosure for Our Readers

This blog contains affiliate links. If you make a purchase through one of these links, our team may earn a commission at no extra cost to you. Learn more. Thanks for your support!

Finding the right platform can revolutionize your financial management processes completely. Poor software choice creates bottlenecks, errors, and missed growth opportunities.

Modern accounting software goes beyond basic bookkeeping. Today’s solutions provide predictive analytics, automated workflows, and real-time business intelligence.

In this comprehensive guide, I’ll share insights from extensive hands-on testing. These recommendations come from real-world implementations across various business sizes and industries.

My Top 15 Accounting Software Platforms for 2025

Here are the best accounting software options I’ve tested and recommend:

- QuickBooks Online – Most comprehensive with extensive app marketplace

- Xero – Best collaboration features with unlimited users

- FreshBooks – Service business specialist with time tracking

- Sage Intacct – Mid-market leader with advanced reporting

- NetSuite – Enterprise ERP with complete business management

- Zoho Books – Budget-friendly with ecosystem integration

- Wave Accounting – Free solution for startups and freelancers

- Kashoo – Simple interface with mobile-first design

- AccountEdge – Desktop solution with hybrid cloud features

- Oracle Financials – Large enterprise with global compliance

- Microsoft Dynamics 365 – Integrated business applications suite

- Intuit Tax – Tax preparation integration specialist

- TaxAct – Professional tax software with accounting features

- ZipBooks – Visual financial insights with smart categorization

- Patriot Software – Payroll-focused with accounting integration

After extensive research, these platforms have impressed me for consistently delivering the best results across different operational requirements.

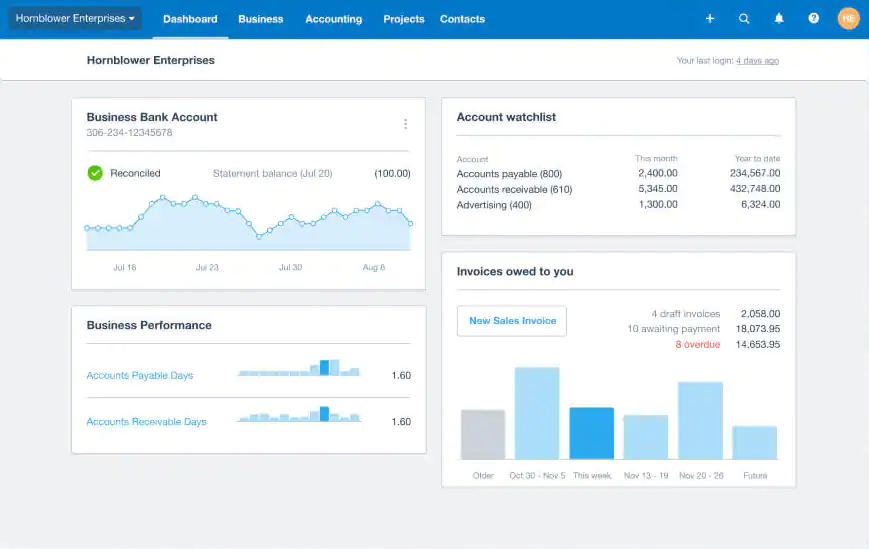

1. QuickBooks Online – The Comprehensive Leader

QuickBooks Online remains my top recommendation for small to medium businesses seeking comprehensive functionality with extensive third-party integrations.

The App Store ecosystem includes over 750 integrations covering every business need. This extensibility makes QuickBooks adaptable to virtually any industry.

Key Features:

| Feature | Capability | Business Benefit |

|---|---|---|

| Bank feeds | Automatic transaction import | Time savings |

| Invoicing | Customizable templates | Professional presentation |

| Reporting | 65+ standard reports | Comprehensive insights |

Advanced automation includes rule-based transaction categorization and automated bank reconciliation. Machine learning improves accuracy over time.

Multi-currency support handles international transactions with real-time exchange rates. Global businesses benefit from automatic currency conversion.

Pricing: Simple Start at $15/month, Plus at $45/month, Advanced at $100/month.

Best For: Growing businesses needing comprehensive features with extensive integration options.

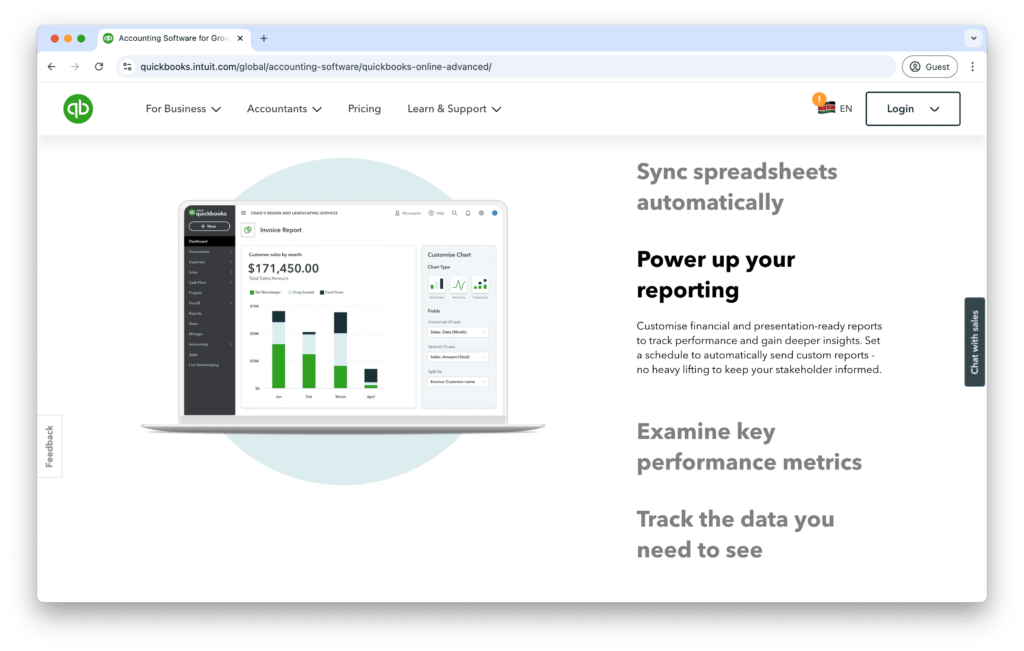

2. Xero – Collaboration Excellence

Xero excels at team collaboration with unlimited users across all subscription plans. The platform prioritizes accessibility and collaborative workflows.

Bank reconciliation technology leads the industry with intelligent matching algorithms. Transaction categorization becomes increasingly accurate with usage.

Collaboration Features:

- Unlimited user access on all plans

- Real-time collaboration on financial documents

- Client portal for accountant communication

- Project tracking with time and expense allocation

Business snapshot dashboard provides instant financial overview without generating formal reports. Key metrics display prominently for quick assessment.

Add-on marketplace includes 1,000+ applications for specialized functionality. Integration options rival QuickBooks’ extensive ecosystem.

Pricing: Early plan at $13/month, Growing at $37/month, Established at $70/month.

Best For: Teams requiring extensive collaboration and unlimited user access.

3. FreshBooks – Service Business Specialist

FreshBooks focuses specifically on service-based businesses with superior time tracking and project management capabilities.

Time tracking integration connects directly with invoicing for accurate billing. Automatic time capture eliminates manual entry and improves accuracy.

Service Business Features:

| Feature | Functionality | Service Benefit |

|---|---|---|

| Time tracking | Automatic capture | Accurate billing |

| Project management | Client collaboration | Better organization |

| Expense tracking | Receipt scanning | Complete cost tracking |

Client portal allows customers to view project progress, approve estimates, and pay invoices online. Self-service options reduce administrative overhead.

Automated payment reminders reduce accounts receivable by an average of 11 days. Customizable reminder sequences improve cash flow significantly.

Pricing: Lite at $17/month, Plus at $30/month, Premium at $55/month.

Best For: Service businesses, consultants, and freelancers prioritizing time tracking and client management.

4. Sage Intacct – Mid-Market Powerhouse

Sage Intacct serves mid-market companies requiring advanced financial management beyond basic accounting functionality.

Dimensional accounting tracks financial data across multiple business aspects simultaneously. Departments, locations, projects, and products receive separate tracking.

Advanced Financial Management:

- Multi-entity consolidation capabilities

- Advanced revenue recognition automation

- Subscription billing and management

- Financial planning and budgeting tools

AI-powered anomaly detection identifies unusual transactions and potential errors automatically. This feature prevents financial mistakes before they impact reporting.

Custom dashboards provide role-specific information to different user types. Executives, managers, and accountants see relevant data for their responsibilities.

Pricing: Custom pricing starting around $15,000 annually for basic implementations.

Best For: Mid-market companies with complex financial structures and multi-entity operations.

5. NetSuite – Enterprise Integration Platform

NetSuite provides unified business management extending beyond accounting to include CRM, inventory, and e-commerce functionality.

Single platform architecture eliminates data silos between business functions. Real-time information sharing improves decision-making across departments.

Enterprise Capabilities:

| Module | Functionality | Integration Benefit |

|---|---|---|

| Accounting | Complete financial management | Core foundation |

| CRM | Customer relationship management | Sales integration |

| Inventory | Supply chain management | Operational efficiency |

| E-commerce | Online store management | Revenue integration |

Industry-specific solutions provide pre-configured functionality for manufacturing, retail, services, and other sectors.

Global business support includes multi-currency, multi-subsidiary, and international compliance features for worldwide operations.

Pricing: Starting at $999/month plus implementation costs. Total investment typically exceeds $50,000 annually.

Best For: Growing enterprises requiring integrated business management beyond accounting.

6. Zoho Books – Budget-Friendly Ecosystem

Zoho Books delivers enterprise-level features at competitive prices within the comprehensive Zoho business application ecosystem.

Ecosystem integration connects seamlessly with Zoho CRM, Projects, Inventory, and other applications. Unified data improves workflow efficiency significantly.

Cost-Effective Features:

- Client portal for customer collaboration

- Automated workflow creation without coding

- Inventory management with reorder points

- Multi-currency and multi-language support

No-code automation allows custom workflow creation without technical expertise. Business rules handle routine tasks automatically.

Project profitability tracking connects time, expenses, and billing for accurate project analysis. Service businesses benefit from comprehensive project insights.

Pricing: Standard at $15/month, Professional at $40/month, Premium at $60/month.

Best For: Budget-conscious businesses using multiple Zoho applications requiring tight integration.

7. Wave Accounting – Free Solution Champion

Wave Accounting provides completely free accounting software with optional paid services for payments and payroll.

Core accounting features include invoicing, expense tracking, and basic reporting without subscription fees. Revenue comes from optional payment processing services.

Free Platform Benefits:

- Unlimited transactions and users

- Bank connection and reconciliation

- Invoice creation and tracking

- Basic financial reporting

Payment processing integration offers competitive rates for credit card and bank transfers. Optional service generates revenue while keeping core features free.

Receipt scanning mobile app captures expense data automatically. OCR technology extracts relevant information for categorization.

Pricing: Free for accounting features. Payment processing at 2.9% + 30¢ per transaction.

Best For: Startups, freelancers, and very small businesses requiring basic accounting functionality.

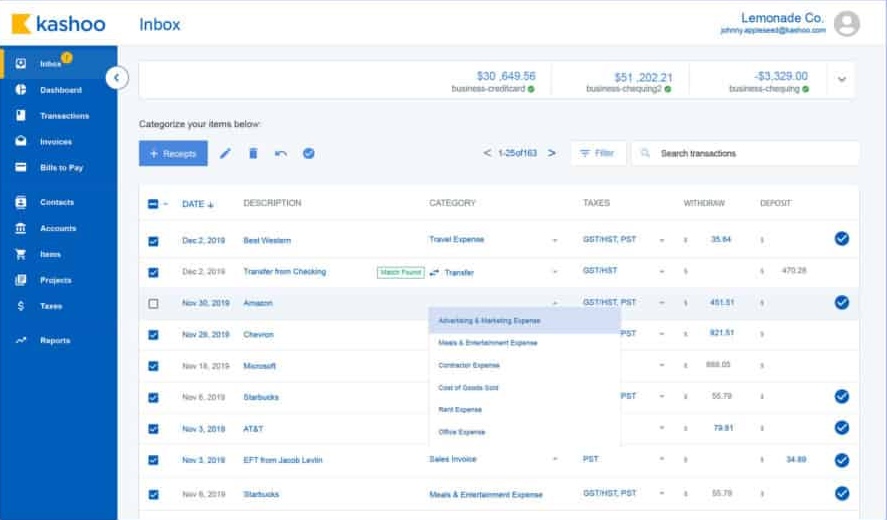

8. Kashoo (Truly Small) – Mobile-First Simplicity

(Source)

Kashoo prioritizes mobile accessibility with intuitive interfaces designed for smartphone and tablet usage.

Simple design philosophy eliminates complex features that overwhelm small business owners. Essential functionality remains easily accessible.

Mobile-Optimized Features:

| Feature | Mobile Benefit | User Experience |

|---|---|---|

| Dashboard | Quick overview | Instant insights |

| Invoicing | On-site creation | Professional efficiency |

| Expenses | Photo capture | Easy tracking |

Cloud synchronization ensures data consistency across all devices. Work seamlessly between mobile and desktop environments.

Customer support includes phone, email, and live chat assistance. Responsive support helps resolve issues quickly.

Pricing: TruelySmall at $20/month, Established at $30/month.

Best For: Mobile-heavy businesses and owners preferring simple, accessible interfaces.

9. AccountEdge – Desktop Hybrid Solution

(Source)

AccountEdge combines desktop software reliability with cloud features for businesses preferring local data control.

Hybrid architecture stores data locally while providing cloud synchronization options. This approach balances control with accessibility.

Desktop-First Advantages:

- Faster performance for large datasets

- Complete data control and security

- Offline functionality when needed

- Customizable interface and workflows

Industry specialization includes versions for nonprofits, retail, and manufacturing with specialized features for each sector.

Network edition supports multiple users in office environments with robust permission controls and data sharing.

Pricing: Pro starts at $149/year, Network Edition at $449/year.

Best For: Businesses preferring desktop software with hybrid cloud capabilities.

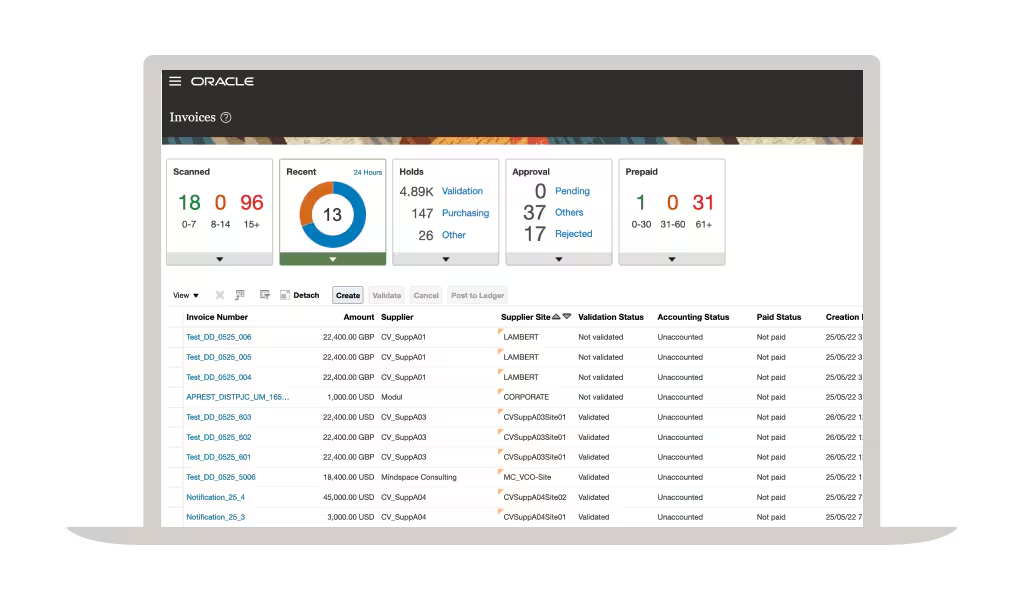

10. Oracle Financials Cloud – Large Enterprise Leader

Oracle Financials serves large enterprises with complex global operations requiring comprehensive financial management capabilities.

Global compliance includes tax engines for 200+ countries and automated regulatory reporting for international operations.

Enterprise Financial Features:

- Advanced consolidation and reporting

- Intercompany transaction management

- Sophisticated budgeting and planning

- Risk management and controls

AI-powered insights provide predictive analytics and anomaly detection at enterprise scale. Machine learning improves over time with usage patterns.

Security and governance meet enterprise requirements with role-based access, audit trails, and compliance monitoring.

Pricing: Custom pricing typically starting at $150+ per user monthly.

Best For: Large enterprises with complex global financial operations and compliance requirements.

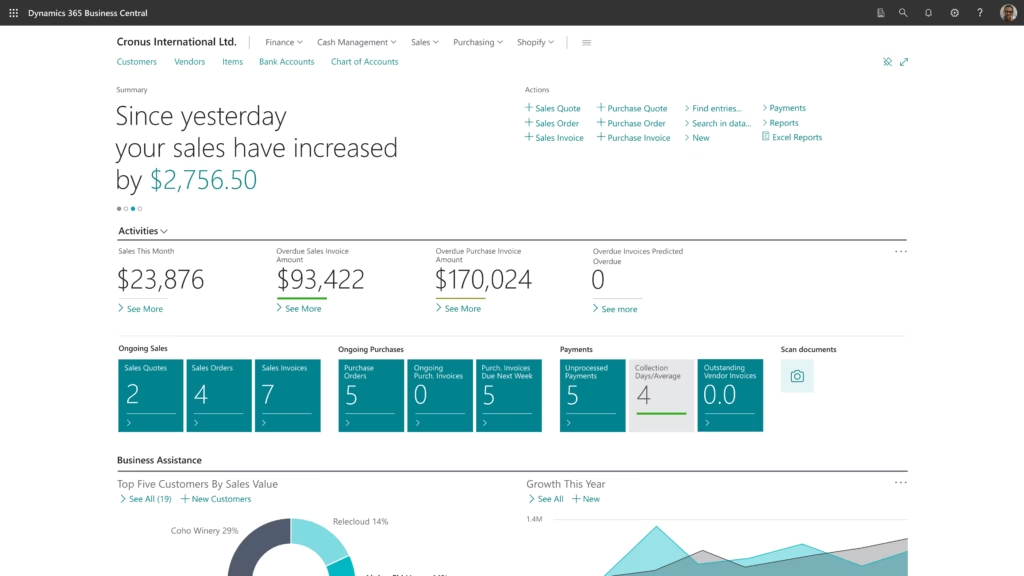

11. Microsoft Dynamics 365 Business Central – Integration Specialist

(Source)

Dynamics 365 Business Central integrates accounting with CRM and operations within the Microsoft ecosystem.

Microsoft integration connects seamlessly with Office 365, Teams, and Power Platform applications. Familiar interfaces reduce training requirements.

Unified Business Platform:

| Module | Integration | Business Value |

|---|---|---|

| Accounting | Core financial management | Foundation |

| Sales | CRM and opportunity tracking | Revenue growth |

| Operations | Inventory and supply chain | Efficiency |

Power BI integration provides advanced analytics and reporting capabilities. Self-service business intelligence empowers decision-making.

Customization options include Power Apps for custom applications and Power Automate for workflow automation.

Pricing: Essentials at $70/user/month, Premium at $100/user/month.

Best For: Microsoft-centric organizations requiring integrated business applications.

12. Intuit Turbotax – Tax Integration Specialist

(Source)

Intuit Tax combines accounting with tax preparation for businesses requiring integrated tax planning and compliance.

Year-round tax planning uses accounting data for strategic tax optimization. Real-time tax impact analysis informs business decisions.

Tax-Focused Features:

- Automated tax form generation

- Multi-state tax compliance

- Tax planning and scenario analysis

- Integrated payroll tax management

Professional tax software includes advanced features for tax preparers and accounting firms serving multiple clients.

QuickBooks integration provides seamless data flow between accounting and tax preparation workflows.

Pricing: Professional plans start at $50/month during tax season.

Best For: Businesses with complex tax situations requiring integrated planning and preparation.

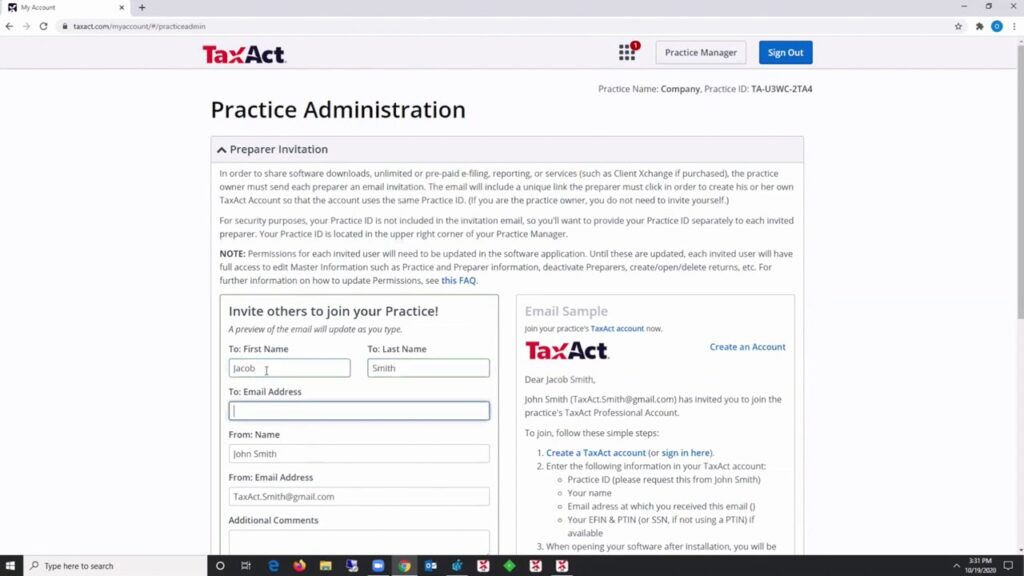

13. TaxAct Professional – Accounting Integration

(Source)

TaxAct Professional provides tax preparation with accounting features for firms serving multiple clients with diverse needs.

Multi-client management handles hundreds of client tax returns with integrated accounting data imports from various platforms.

Professional Features:

- Unlimited e-filing capabilities

- Advanced tax research tools

- Client portal for document sharing

- Practice management integration

Accounting integration imports data from major accounting platforms automatically. This connectivity reduces manual data entry significantly.

Pricing transparency includes flat-rate pricing without per-return fees. Predictable costs help firm profitability planning.

Pricing: Professional plans start at $1,000 annually for unlimited returns.

Best For: Tax preparation firms requiring accounting integration and multi-client management.

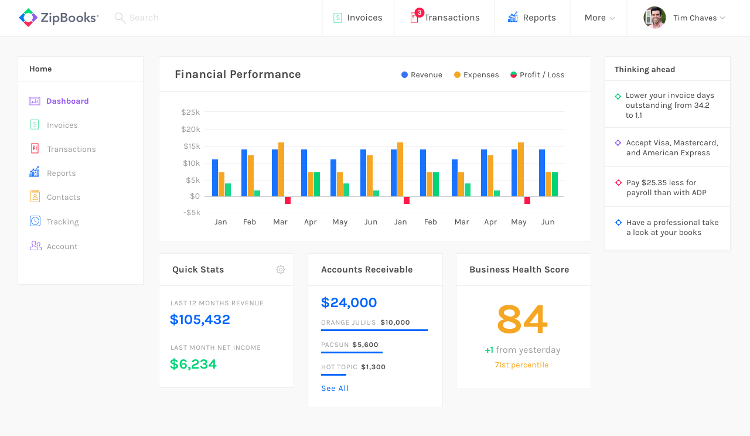

14. ZipBooks – Visual Insights Platform

(Source)

ZipBooks emphasizes visual financial insights with smart categorization and intuitive dashboard design.

Intelligent categorization uses machine learning to automatically sort transactions into appropriate categories. Manual categorization becomes unnecessary.

Visual Financial Management:

| Feature | Visual Element | Business Insight |

|---|---|---|

| Cash flow | Interactive graphs | Trend analysis |

| Profitability | Color-coded metrics | Quick assessment |

| Budgeting | Progress indicators | Goal tracking |

Smart invoicing includes automatic payment reminders and online payment options. Accounts receivable management improves cash flow.

Time tracking integration connects project work with billing for accurate profitability analysis.

Pricing: Free plan available, Premium at $15/month.

Best For: Visual learners and businesses prioritizing intuitive financial insights.

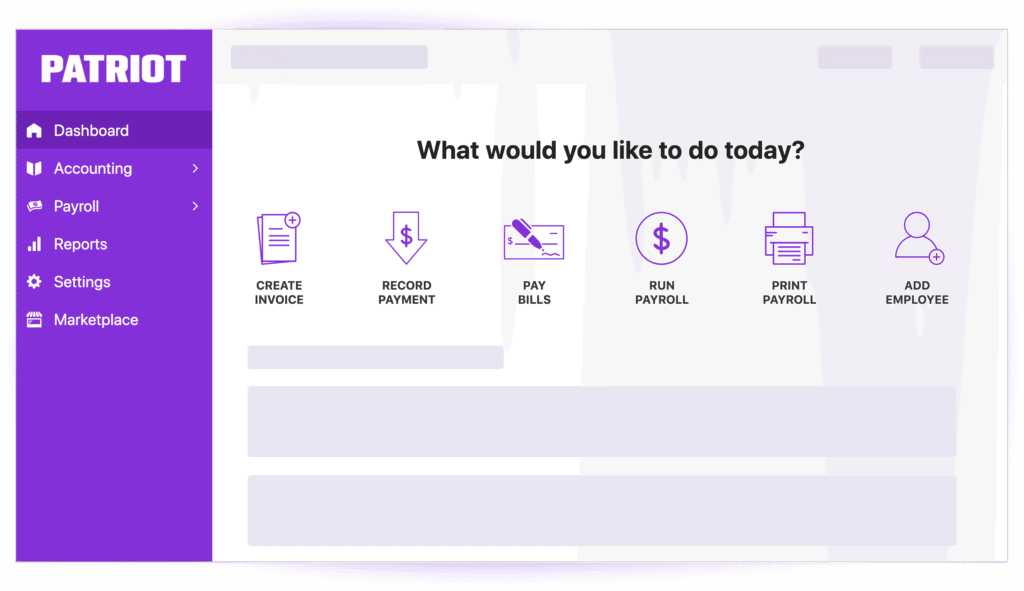

15. Patriot Software – Payroll-Focused Accounting

(Source)

Patriot Software specializes in payroll processing with integrated accounting features for businesses prioritizing employee management.

Full-service payroll includes tax filing, direct deposit, and compliance management. Automated payroll reduces administrative burden significantly.

Payroll-Centric Features:

- Automated tax calculations and filing

- Employee self-service portal

- Workers’ compensation integration

- HR document management

Accounting integration ensures payroll costs flow seamlessly into financial statements. Labor cost tracking improves profitability analysis.

Affordable pricing provides comprehensive payroll and accounting functionality at competitive rates.

Pricing: Full-service payroll starts at $17/month plus $4 per employee.

Best For: Small businesses prioritizing comprehensive payroll management with basic accounting needs.

Ready to Choose Your Accounting Tool?

Accounting software selection profoundly impacts business operations, financial accuracy, and strategic decision-making capabilities. The right platform transforms financial management.

Modern automation capabilities reduce manual work while improving accuracy and providing real-time insights for better business decisions.

Focus on solutions that integrate well with existing systems and provide scalability for changing requirements. Avoid platforms that create new silos or limit future options.

Remember that accounting software serves as the financial foundation for business operations. Choose platforms that support current needs while accommodating future growth.