Power Tools

Disclosure for Our Readers

This blog contains affiliate links. If you make a purchase through one of these links, our team may earn a commission at no extra cost to you. Learn more. Thanks for your support!

When I first started my business, my finances were a mess. I was juggling spreadsheets, invoices, and a shoebox full of receipts. It was pure chaos.

I knew I needed a real accounting software solution. Everyone, and I mean everyone, pointed me toward QuickBooks. It’s the undisputed giant in the small business world.

But is the biggest always the best for you? The hype is real, but so are the frustrations I’ve read about on Reddit and G2.

This in-depth review cuts through the noise. We’ll explore its powerful features, frustrating flaws, and who should actually use it. Let’s see if it earns a spot in your tech stack.

What Exactly is QuickBooks?

QuickBooks is a comprehensive financial management suite. It was created by Intuit to simplify business accounting. It helps you track all the money moving in and out.

The platform comes in two main flavors. You have QuickBooks Online (QBO), the cloud-based version. Then there’s QuickBooks Desktop, the traditional software. This review focuses primarily on QBO.

It aims to be an all-in-one hub. From invoicing clients to running payroll, QuickBooks wants to handle it all for you.

A Deep Dive into Core QuickBooks Features

QuickBooks is packed with tools. Some are incredibly intuitive, while others have a steeper learning curve. Let’s break down the most important ones for your business.

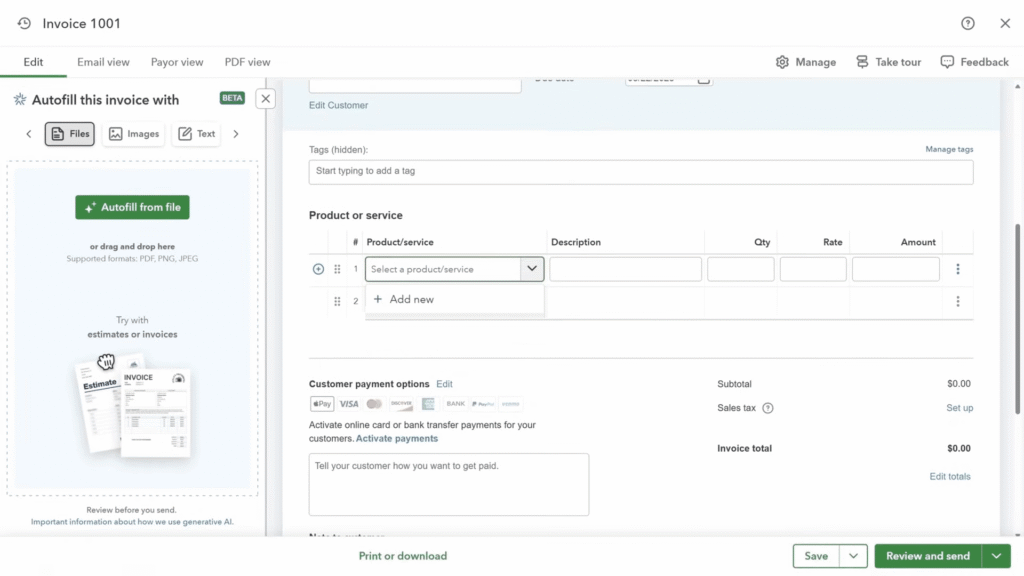

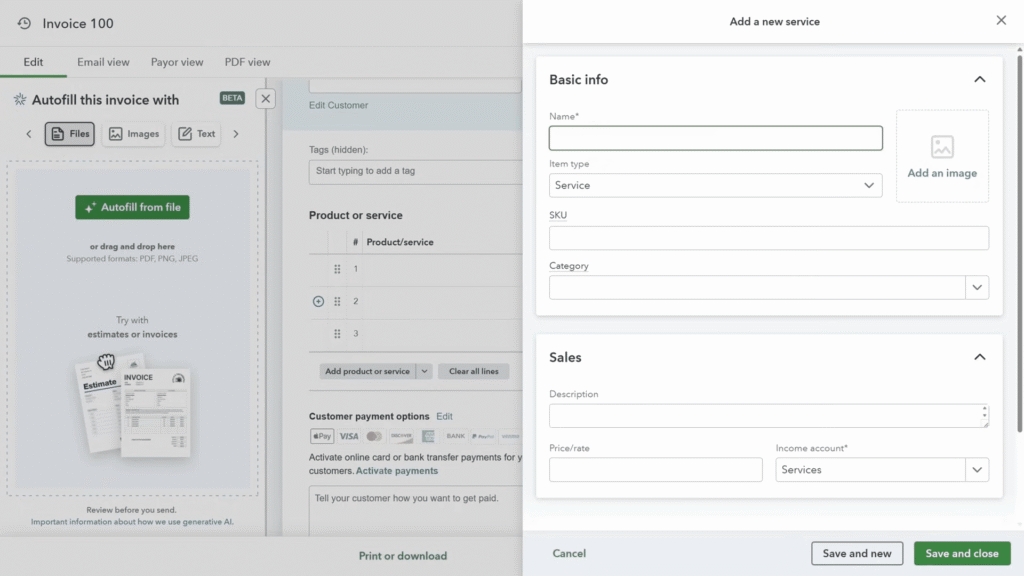

1. Invoicing and Getting Paid Faster

Creating and sending invoices is simple. You can choose from several templates and customize them with your logo and brand colors. This helps maintain a professional look.

A standout feature is payment links. You can add a “Pay Now” button directly to your invoices. This lets clients pay instantly with a credit card or ACH transfer.

The system also sends automatic payment reminders. This simple feature can drastically reduce your time chasing down late payments. It’s a huge time-saver for any small business.

2. Effortless Expense and Receipt Tracking

This is where QuickBooks truly shines for many users. You can connect your business bank and credit card accounts directly. Transactions are automatically imported and categorized.

The mobile app is a game-changer. Just snap a photo of a receipt. QuickBooks uses OCR technology to pull the data and match it to an expense.

This nearly eliminates manual data entry. It also ensures you’re ready for tax time with a clear, digitized paper trail. This is a core part of any good expense management system.

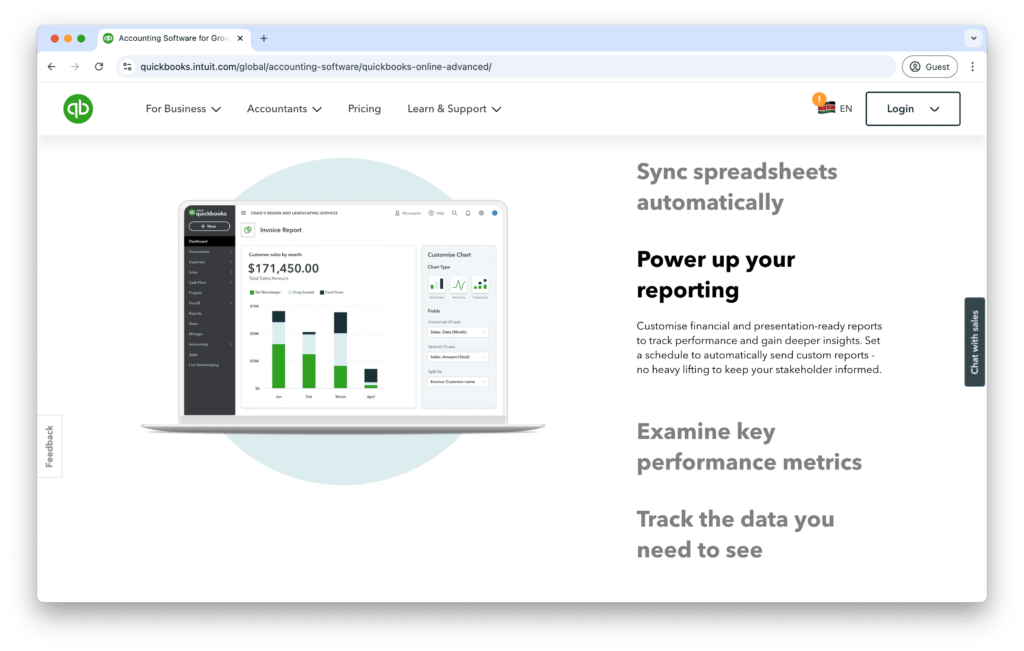

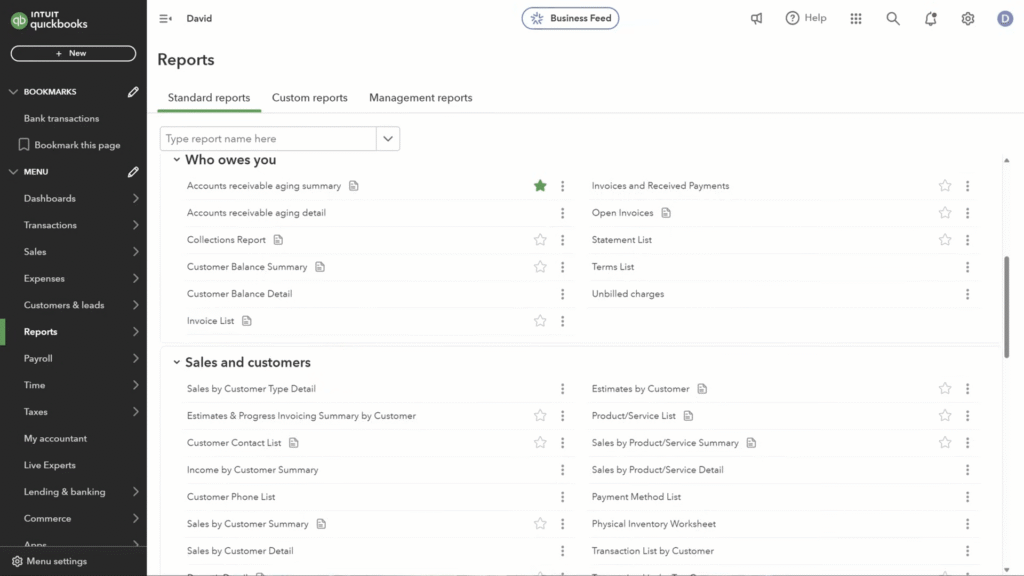

3. Powerful Financial Reporting

QuickBooks offers a vast library of reports. You can generate essential statements with just a few clicks. This includes your Profit & Loss, Balance Sheet, and Cash Flow statements.

These reports are your business’s financial health check. They provide the insights needed to make smart, data-driven decisions about your company’s future.

While the basic reports are great, customization can be limited. Advanced users might find themselves wanting more granular control over the data they can pull and display.

Key Reports at a Glance

| Report Name | What It Shows | Why It Matters |

| Profit & Loss | Revenue vs. Expenses | Measures business profitability |

| Balance Sheet | Assets, Liabilities, Equity | Provides a financial snapshot |

| Cash Flow | Money In vs. Out | Shows liquidity health |

4. Integrated Payroll Services

QuickBooks offers its own payroll services as an add-on. This keeps your payroll and accounting data perfectly synced in one place. No more double entries.

It handles payroll tax calculations and filings. The system can even pay your employees via direct deposit. This automates a very complex business function.

However, this convenience comes at a cost. The payroll plans are an additional monthly fee on top of your main QuickBooks subscription.

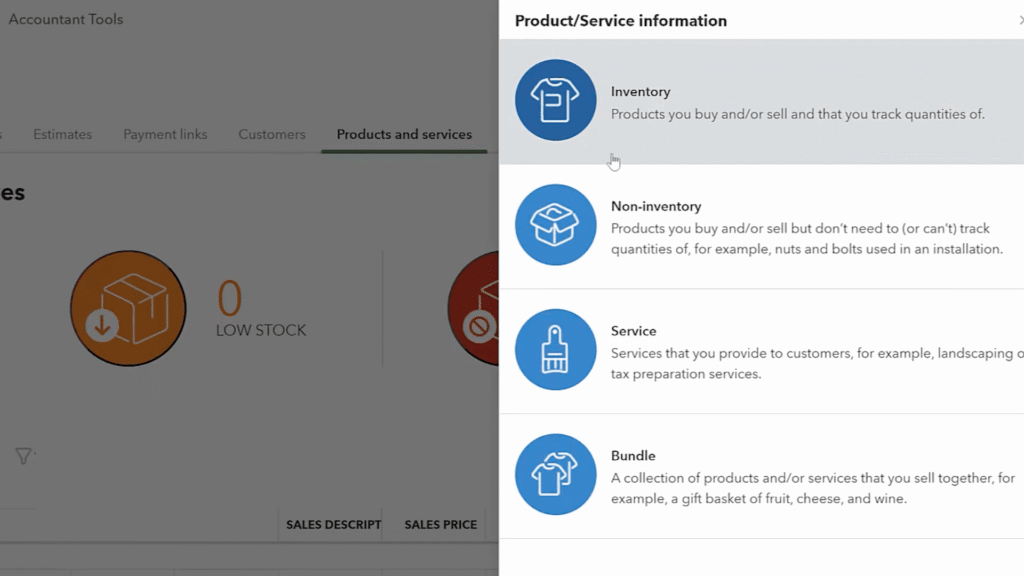

5. Inventory Management for Product Businesses

For businesses that sell physical goods, inventory control is critical. QuickBooks Online Plus and Advanced plans include inventory tracking. It’s a solid, if basic, feature.

You can track stock levels and costs. The system will also notify you when inventory is running low, helping you avoid stockouts.

However, businesses with complex needs may find it lacking. Companies needing barcode scanning or advanced kitting might need a dedicated third-party app.

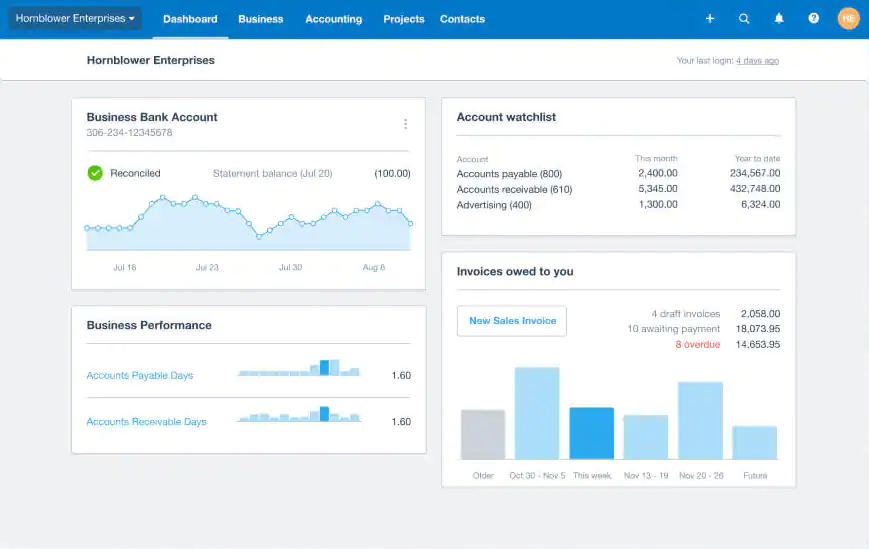

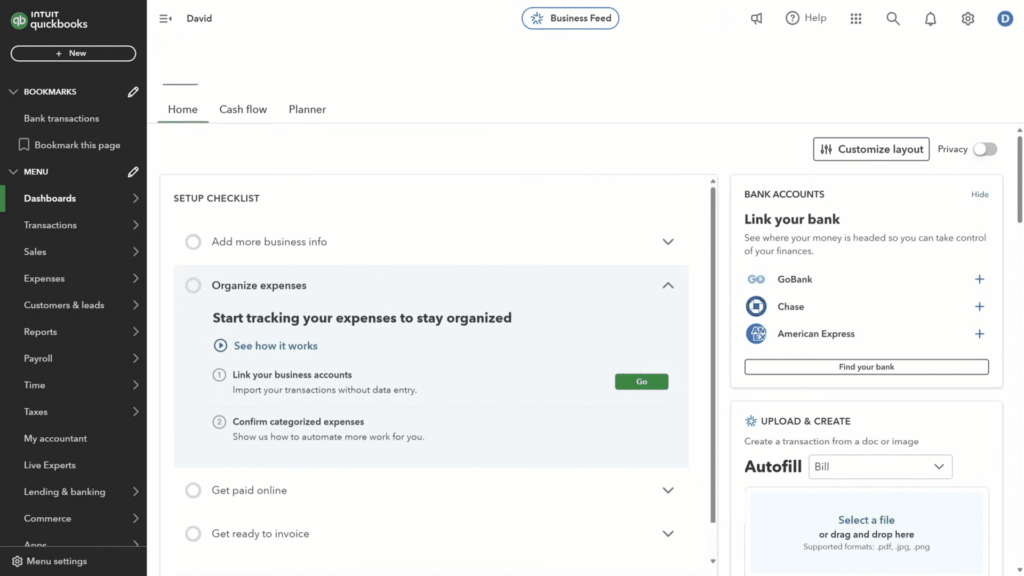

The QuickBooks User Experience

The QuickBooks dashboard is generally clean and well-organized. It presents a clear overview of your business’s financial status right when you log in.

However, the user experience can be inconsistent. Some tasks are incredibly simple, while others are buried in menus that feel less than intuitive.

New users should expect a learning curve. While basic tasks are easy, mastering the platform’s full potential takes time and patience. Many users rely on tutorials or an accountant.

Understanding QuickBooks Pricing

QuickBooks Online pricing is tiered. Each plan unlocks more features and supports more users. Choosing the right one depends on your business’s size and complexity.

QuickBooks Online Plans

| Plan Name | Best For | Standout Feature |

| Simple Start | Solopreneurs | Basic income tracking |

| Essentials | Small Businesses | Bill management |

| Plus | Growing Businesses | Inventory & profitability |

| Advanced | Larger SMEs | Advanced business analytics |

Be aware of the frequent promotions. Intuit often offers a significant discount for the first three months. But be sure to budget for the full price afterward.

Also, remember add-on costs. Services like payroll, payments processing, and live bookkeeping are extra. These can add up quickly.

The Pros and Cons: A Balanced View

No software is perfect. Based on my experience and extensive user feedback, here is where QuickBooks excels and where it stumbles.

What We Love About QuickBooks

- Comprehensive Features: It has nearly every accounting tool a small business could need. It’s a true all-in-one solution for most.

- Vast Accountant Network: Virtually every accountant knows QuickBooks. This makes collaboration and tax filing incredibly smooth and efficient.

- Strong Integrations: It connects with hundreds of third-party apps. This allows you to build a powerful and customized business tech stack.

- Scalability: The platform can grow with your business. You can easily upgrade your plan as your needs become more complex over time.

Where QuickBooks Falls Short

- Customer Support: This is the most common complaint. Users often report long wait times and unhelpful support experiences. It can be very frustrating.

- High Cost: QuickBooks is one of the more expensive options on the market. The price can be a significant hurdle for new or lean businesses.

- Occasional Glitches: Like any cloud software, it can be buggy. Users sometimes report sync errors or features temporarily not working as expected.

- Steep Learning Curve: While basics are simple, advanced features are not. Unlocking its full power often requires a significant time investment.

Top QuickBooks Alternatives

If QuickBooks doesn’t feel right, you have options. The accounting software market is competitive, with several strong players.

How Competitors Stack Up

| Competitor | Known For | Ideal User |

| Xero | Beautiful user interface | Tech-savvy small businesses |

| FreshBooks | Excellent invoicing | Freelancers & consultants |

| Wave | Completely free plan | Solopreneurs on a budget |

Each of these alternatives has its own strengths. Xero is often praised for its design, while FreshBooks is laser-focused on service-based businesses.

The Final Verdict: Is QuickBooks Worth It for You?

So, after all this, should QuickBooks be in your stack? The answer is a classic “it depends.”

You should seriously consider QuickBooks if:

- You are a growing business that needs a scalable solution.

- You work closely with an accountant (they likely prefer it).

- You need robust, all-in-one features like inventory and payroll.

- You rely on many third-party app integrations.

You might want to look elsewhere if:

- You are on a very tight budget.

- You prioritize excellent, responsive customer support.

- You are a freelancer who only needs simple invoicing and expense tracking.

- You get easily frustrated by a complex user interface.

QuickBooks remains the king of accounting software for a reason. Its feature set is unmatched, and its integration with the accounting profession is undeniable.

But its reign is no longer absolute. High costs and poor support have opened the door for strong competitors. It’s a powerful tool, but make sure its strengths align with your needs before you commit.