Disclosure for Our Readers

This blog contains affiliate links. If you make a purchase through one of these links, our team may earn a commission at no extra cost to you. Learn more. Thanks for your support!

Choosing the right accounting software feels like a huge commitment. It’s the financial backbone of your entire operation. A wrong move here can lead to months of headaches.

For years, I only heard one name: QuickBooks. It’s the titan of the industry, the default choice for millions. It felt like the only real option on the table.

Then I kept hearing whispers about a challenger from New Zealand. A platform called Xero, praised for its “beautiful accounting software.” It promised a modern, user-friendly experience.

So, we’re putting them head-to-head. Let’s see which one truly deserves a spot in your tech stack.

Getting to Know the Contenders

Before we dive deep, let’s establish who we’re dealing with. These two platforms approach the same problem from slightly different angles.

What is QuickBooks?

QuickBooks is the undisputed industry standard. It’s a powerful, feature-rich tool that every accountant knows. This makes it a safe, reliable choice for millions of businesses worldwide.

What is Xero?

Xero is the sleek, modern challenger. It was built from the ground up for the cloud. Xero emphasizes a clean user interface and unlimited users on all its plans.

The Feature-by-Feature Breakdown

A pretty design means nothing if the features don’t work for you. We’ll compare the core functions that matter most to a small business owner.

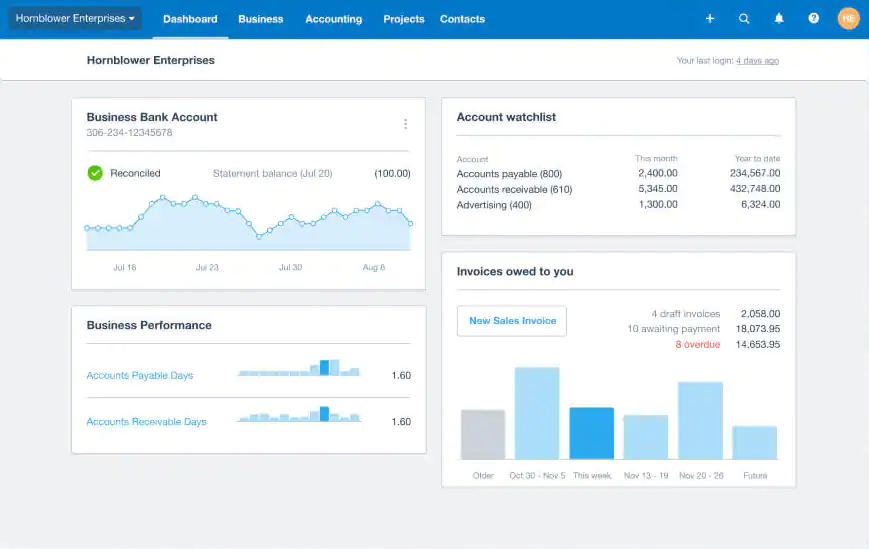

1. User Interface and Ease of Use

(Source)

This is where the two platforms diverge the most. Your daily experience will be shaped by how you navigate the software.

QuickBooks is powerful but can feel cluttered. Its interface is dense with options, which can be overwhelming for new users. There’s a definite learning curve involved.

Xero, on the other hand, is known for its clean, intuitive design. Dashboards are easy to customize and understand. Most users find it easier to pick up.

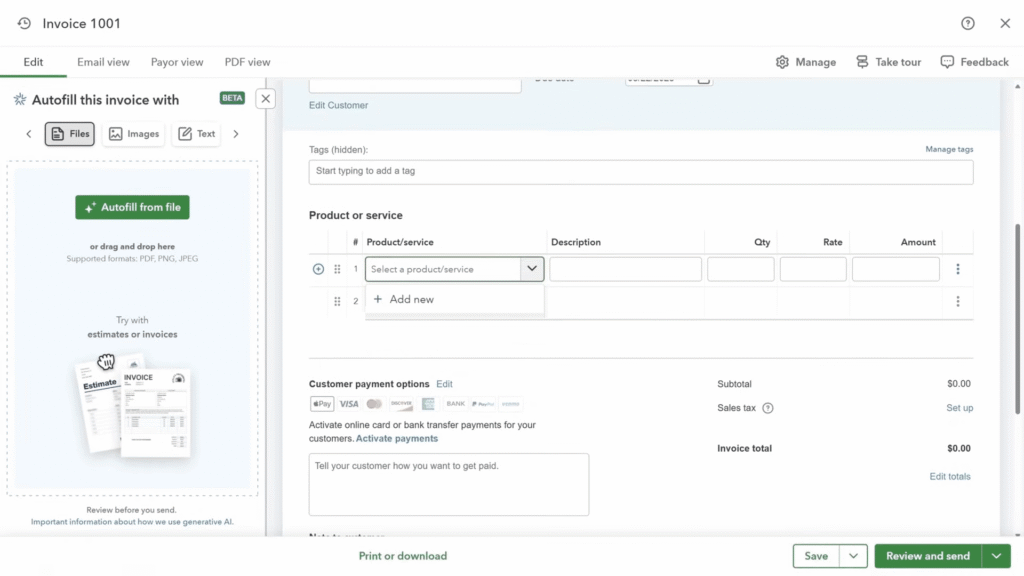

2. Invoicing and Payments

Both platforms handle invoicing very well. You can create custom, professional invoices, set up recurring bills, and send automatic payment reminders.

QuickBooks offers slightly more customization on its invoice templates. It also has a robust “Pay Now” feature through its own payment processing system.

Xero’s invoicing is incredibly straightforward. It integrates smoothly with Stripe and GoCardless, offering flexible payment solutions for your clients.

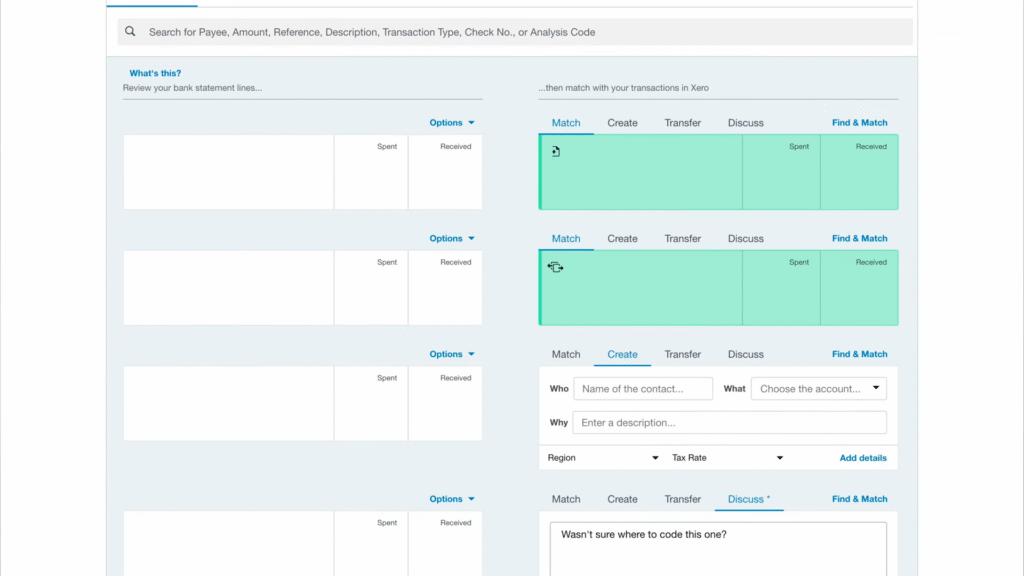

3. Bank Reconciliation

This is a core accounting task. Matching your bank transactions to your books needs to be simple.

Xero’s bank reconciliation screen is often cited as its best feature. It’s a simple, single-screen process that makes matching transactions fast and almost game-like.

QuickBooks has a powerful reconciliation tool as well. It automatically suggests matches, but the overall workflow can feel a bit more complex than Xero’s.

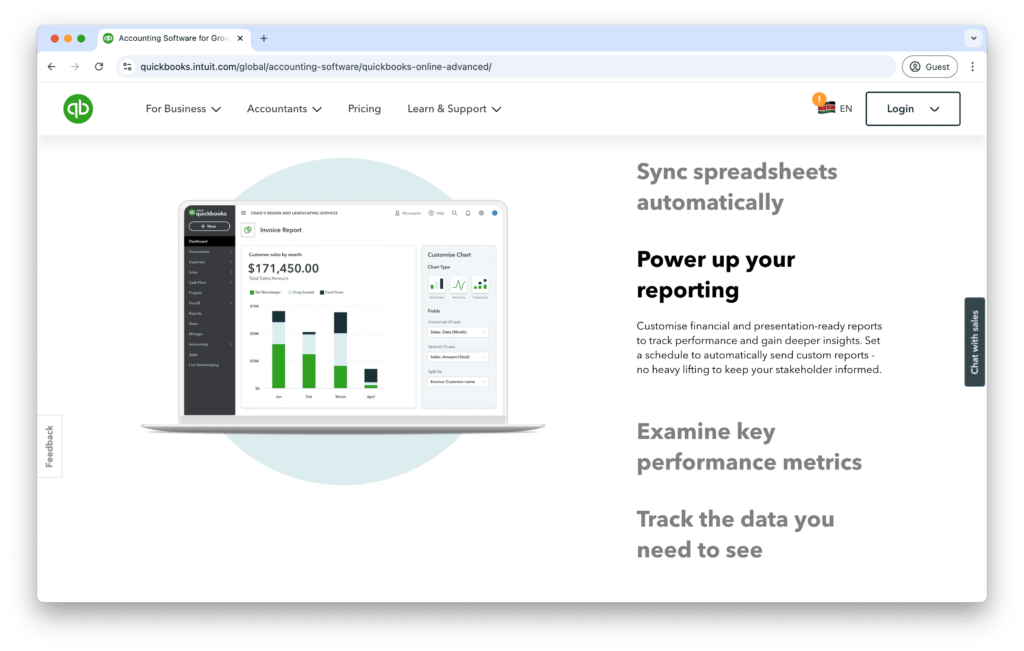

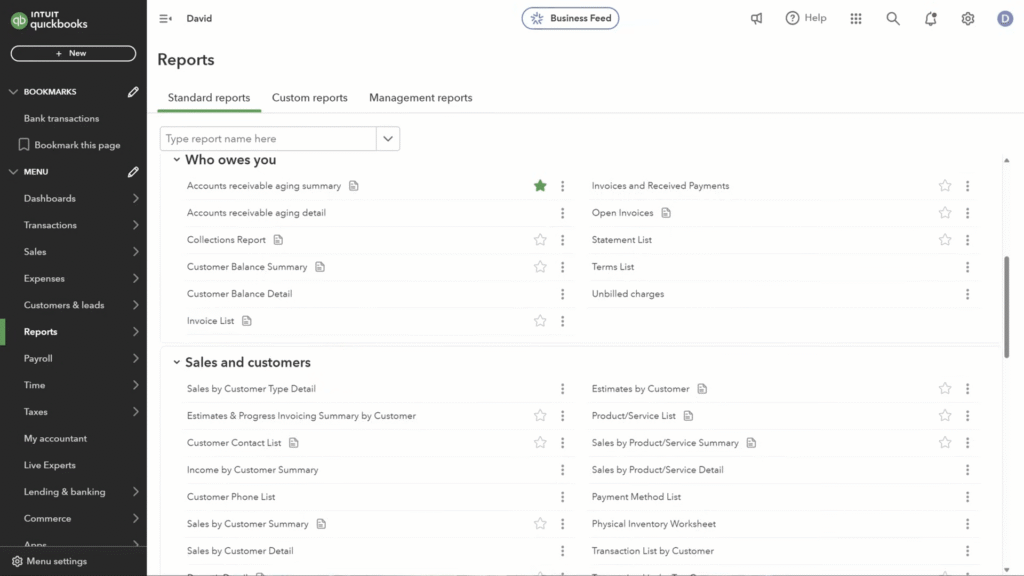

4. Reporting and Analytics

Good data leads to good decisions. Both tools offer a suite of standard financial reports. This includes Profit & Loss, Balance Sheets, and more.

QuickBooks generally has a more extensive library of built-in reports. Its higher-tier plans also offer more advanced customization and business analytics tools.

Xero’s reports are clean and easy to understand. While its library isn’t as vast, it covers all the essentials a small business needs. Customization is solid.

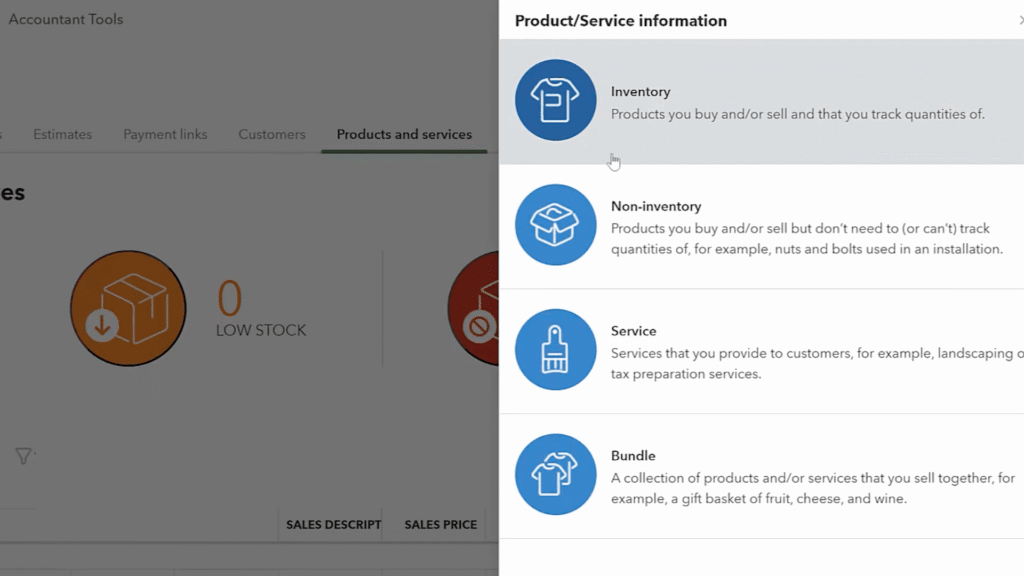

5. Inventory Management

If you sell physical products, inventory control is non-negotiable. This feature is only available on the higher-tier plans for both platforms.

QuickBooks Plus and Advanced plans offer robust inventory tools. It tracks costs, quantities, and sends low-stock alerts. It’s a more developed system.

Xero’s inventory feature is more basic. It handles the fundamentals well but lacks advanced features. Businesses with complex inventory may need an add-on.

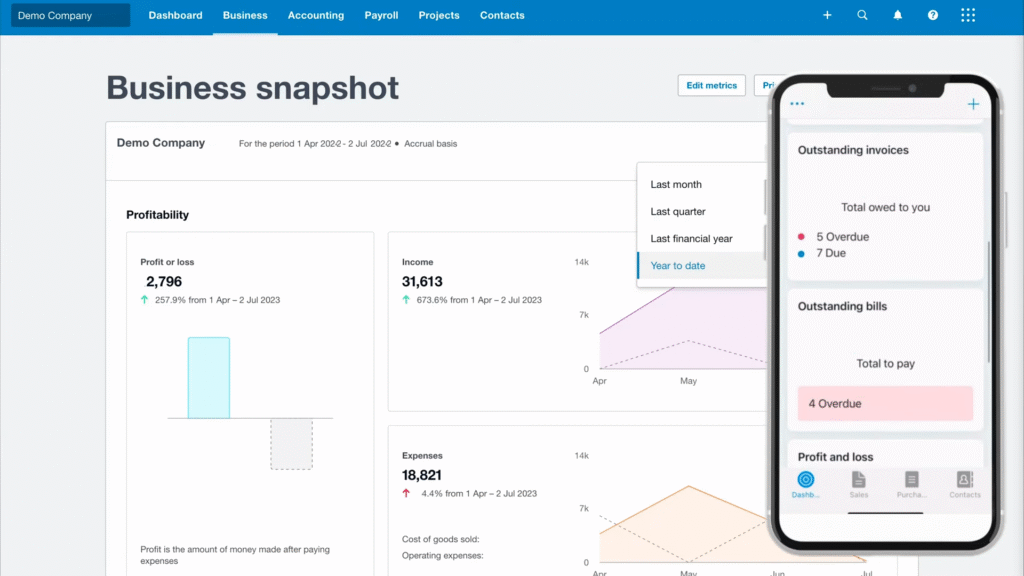

6. Mobile App Experience

Running a business doesn’t just happen at a desk. A good mobile app is essential for expense management and invoicing on the go.

Both QuickBooks and Xero have excellent, full-featured mobile apps. You can create invoices, snap receipt photos, and reconcile transactions from your phone.

Honestly, it’s a tie here. Both apps are well-designed and highly functional, making either a great choice for the mobile-first business owner.

Pricing: A Head-to-Head Cost Analysis

Pricing structures can be confusing. The sticker price rarely tells the whole story. Here’s how they compare on the key cost-related features.

| Feature | QuickBooks | Xero |

| Starting Price | Generally higher | More affordable entry |

| User Limits | Capped by plan | Unlimited on all plans |

| Inventory Tracking | On higher-tier plans | On higher-tier plans |

| Payroll Service | Paid add-on | Paid add-on (Gusto) |

Xero’s inclusion of unlimited users on every plan is its biggest pricing advantage. With QuickBooks, you have to pay more as your team grows.

Customer Support: Who Has Your Back?

When something goes wrong, you need help fast. Customer support is a critical, and often overlooked, part of the package.

QuickBooks support is its most criticized feature. Users consistently report long wait times and difficulty getting helpful answers. This can be incredibly frustrating.

Xero offers 24/7 online support through a ticketing system. While there’s no direct phone line, users generally report faster and more helpful responses.

The Final Verdict: Side-by-Side Summary

Let’s distill this entire comparison down into a simple, easy-to-read table to help you decide.

| Area of Comparison | Winner | Why It Wins |

| Ease of Use | Xero | Cleaner, more intuitive interface |

| Reporting | QuickBooks | More reports, better customization |

| Accountant Preference | QuickBooks | The dominant industry standard |

| Pricing Structure | Xero | Unlimited users on all plans |

| Mobile App | Tie | Both apps are excellent |

| Customer Support | Xero | More responsive, helpful support |

| Integrations | Tie | Both have huge app marketplaces |

Who Should Choose QuickBooks?

Despite its flaws, QuickBooks is a powerhouse for a reason. It’s the right choice for specific types of businesses.

- You should choose QuickBooks if:

- Your accountant demands it. Don’t underestimate this factor.

- You need detailed, highly customizable financial reports.

- You have complex inventory needs and want a built-in solution.

- You are a larger or rapidly scaling business.

Who Should Choose Xero?

Xero’s modern approach and user-friendly design make it a compelling alternative that is perfect for others.

- You should choose Xero if:

- You prioritize ease of use and a clean interface.

- You have multiple team members who need access.

- You are a startup or a tech-savvy small business.

- You value responsive customer support.

The Bottom Line

There is no single “best” accounting software. The battle between QuickBooks and Xero is a battle between power and simplicity.

QuickBooks is the comprehensive, feature-packed giant. It can do almost anything, but it asks you to learn its complex ways.

Xero is the elegant, user-focused challenger. It makes daily accounting tasks feel effortless and collaborative.

The best choice depends entirely on your business’s unique needs, your budget, and your technical comfort level. Choose the tool that will cause you the least friction.