Smart Picks

Disclosure for Our Readers

This blog contains affiliate links. If you make a purchase through one of these links, our team may earn a commission at no extra cost to you. Learn more. Thanks for your support!

For years, I thought accounting software had to be complicated. It felt like a necessary evil—a clunky, intimidating program I had to wrestle with every month.

Then I started hearing about Xero. People didn’t just use it; they seemed to genuinely like it. They called it “beautiful” and “intuitive,” words I never associated with finance.

The praise was intriguing, but I was skeptical. Could a platform focused on design still have the power a serious business needs? Or was it just a pretty face?

This in-depth Xero review explores every corner of the platform. We’ll uncover its unique strengths, its surprising weaknesses, and who should seriously consider making the switch.

What is Xero, Exactly?

Xero is a cloud-based accounting platform designed for small and medium-sized businesses. It was born in the cloud, not adapted for it, which shapes its entire user experience.

It aims to make accounting more collaborative and less of a chore. Xero’s philosophy centers on a clean design, powerful automation, and a strong ecosystem of connected apps.

One of its most famous features is offering unlimited users on every plan. This signals that it’s built for teamwork between you, your staff, and your accountant.

A Tour of Xero’s Core Features

Xero is packed with tools to manage your finances. Let’s break down the most important features and see how they perform in the real world.

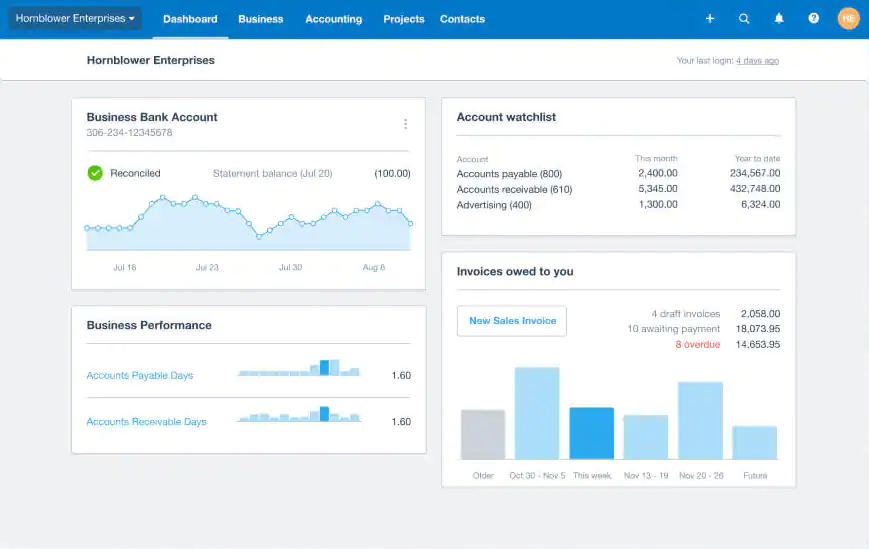

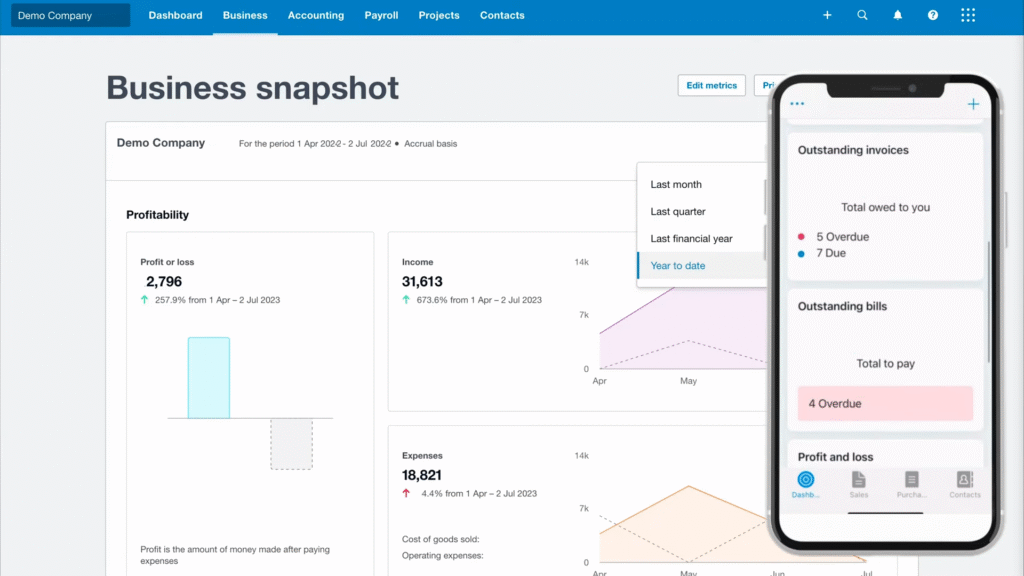

1. The Clean and Customizable Dashboard

The first thing you’ll notice about Xero is its dashboard. It’s clean, modern, and gives you an instant snapshot of your business’s financial health.

You can customize it to show what matters most. Track your bank balances, outstanding invoices, and upcoming bills all in one place. It’s powerful without being overwhelming.

2. Effortless Invoicing

Creating and sending professional invoices is simple in Xero. You can use pre-made templates or customize them with your own branding for a consistent look.

The platform excels at automation. Set up recurring invoices for regular clients, and send automatic reminders for overdue payments. This helps you get paid faster with less effort.

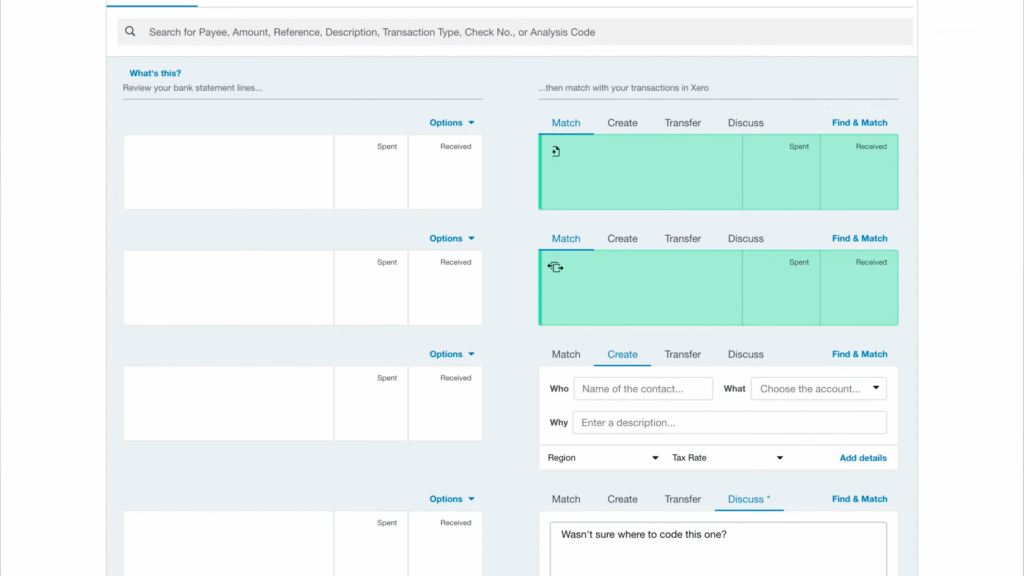

3. The Famous Bank Reconciliation

This is where Xero has a massive fan base. Its bank reconciliation screen is widely considered the best in the business. It makes a tedious task almost enjoyable.

Xero presents your bank transactions on one side and suggests matches on the other. You just have to click “OK.” It’s fast, intuitive, and incredibly efficient.

4. Expense and Bill Management with Hubdoc

Every Xero plan includes Hubdoc, its expense management tool. You can forward bills or snap photos of receipts with the mobile app.

Hubdoc automatically extracts the key data. This eliminates manual data entry and creates a digital paper trail for all your expenses. It’s a huge time-saver come tax season.

Key Hubdoc Features

| Feature | What It Does | Benefit for You |

| Receipt Capture | Scans receipts via app | Eliminates manual data entry |

| Bill Fetching | Connects to supplier accounts | Automates bill collection |

| Data Extraction | Reads vendor, date, amount | Ensures accurate records |

5. Clear and Actionable Reporting

Xero offers a solid range of financial reports. You can easily generate your Profit & Loss, Balance Sheet, and other essential statements.

The reports are easy to read and understand. While they may not have the deep customization of some rivals, they provide the key insights most small businesses need to thrive.

6. Basic Inventory Tracking

For businesses selling products, Xero includes basic inventory control. You can track stock levels, costs, and see what your most profitable items are.

This feature is great for businesses with simple needs. However, if you require advanced tools like barcode scanning or variant tracking, you’ll need a dedicated third-party app.

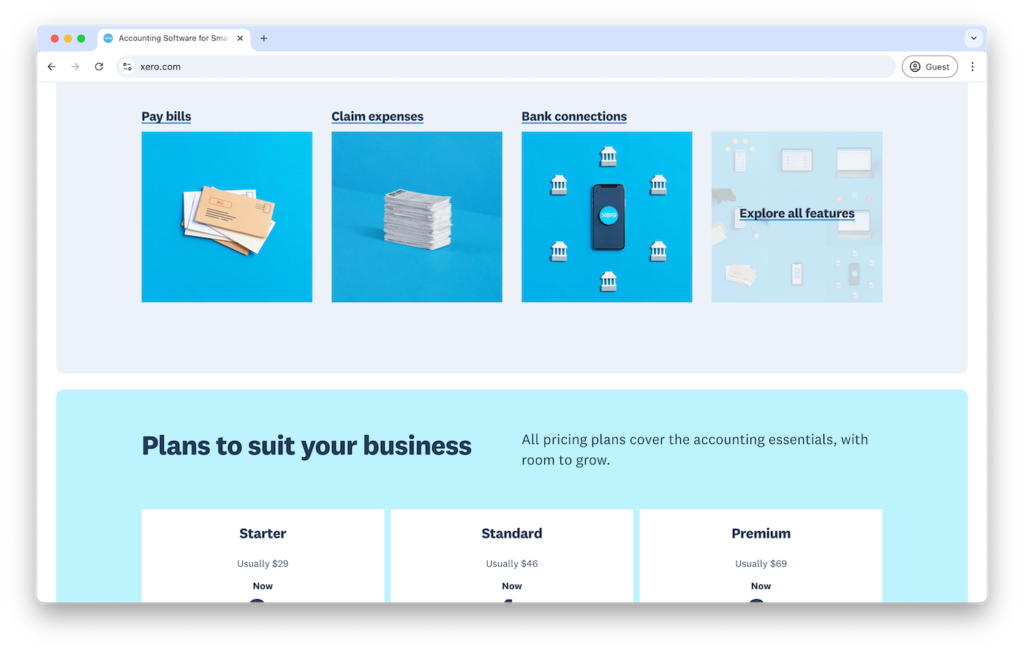

Understanding Xero’s Pricing Plans

Xero’s pricing is straightforward and competitive. Its main advantage is that all plans include unlimited users, which is a massive benefit for growing teams.

Xero Subscription Tiers

| Plan Name | Best For | Key Limitation |

| Early | New Solopreneurs | Limits on invoices/bills |

| Growing | Most Small Businesses | The standard, full-featured plan |

| Established | Global Businesses | Includes multi-currency support |

Remember to consider add-on costs. Services like payroll (managed through Gusto in the US) and project tracking are additional monthly fees.

The Pros and Cons of Xero

No platform is perfect for everyone. Based on user feedback and my own experience, here’s a balanced look at where Xero shines and where it stumbles.

What We Love About Xero

- Beautiful User Interface: It’s clean, intuitive, and genuinely pleasant to use on a daily basis.

- Unlimited Users: This is a huge value proposition. You never pay more as your team or accountant collaboration grows.

- Top-Tier Bank Reconciliation: It turns one of the most tedious accounting tasks into a quick and easy process.

- Excellent Mobile App: The app is full-featured, allowing you to manage your business from anywhere.

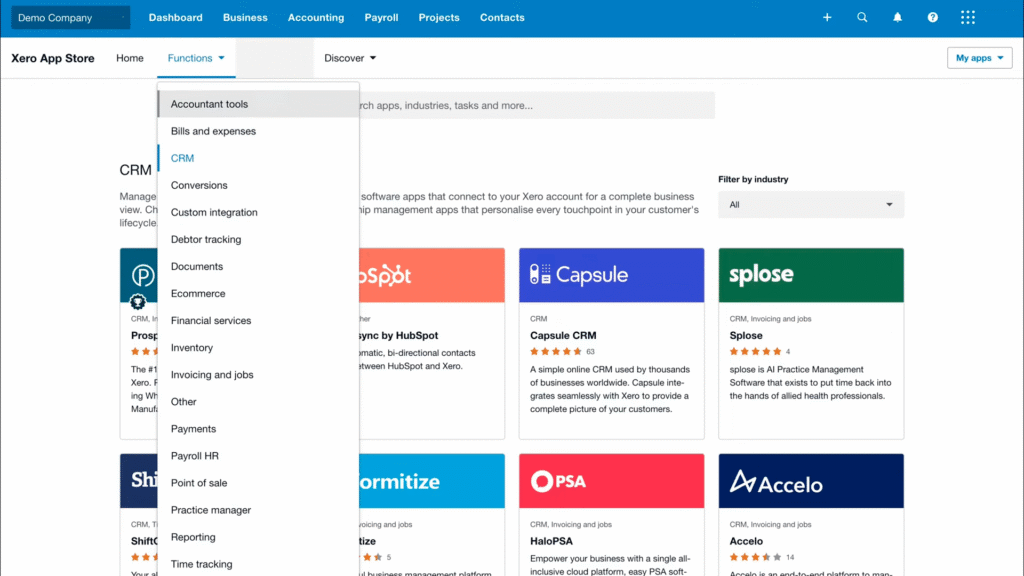

- Strong App Ecosystem: Xero integrates with over 1,000 third-party business apps, allowing for deep customization.

Where Xero Could Improve

- Limited Customer Support: Support is only available via an online ticketing system. There is no direct phone number, which can be frustrating in an emergency.

- Basic Inventory: The built-in inventory management is too simple for businesses with complex stock requirements.

- Fewer Accountant Users: While growing, fewer US-based accountants use Xero as their primary tool compared to its main rival.

- Basic Payroll: The integrated payroll services (via Gusto) are solid, but not as deeply embedded as some competitors’ offerings.

Top Xero Alternatives

If Xero doesn’t sound like the right fit, the market has other excellent options that might better suit your business needs.

How Competitors Stack Up

| Competitor | Known For | Ideal User |

| QuickBooks Online | Power and features | Businesses needing robust reporting |

| FreshBooks | Excellent invoicing | Freelancers and service businesses |

| Wave | Completely free plan | Solopreneurs on a budget |

The Final Verdict: Is Xero Worth It for Your Business?

After a deep dive, it’s clear why Xero has such a loyal following. It successfully transformed accounting from a chore into a manageable, even pleasant, business function.

You should choose Xero if:

- You prioritize user experience and a clean design.

- You have a growing team and need unlimited user access.

- You are a tech-savvy business owner who values a modern interface.

- You want to make bank reconciliation as painless as possible.

You might want to look elsewhere if:

- You need immediate phone support for urgent issues.

- Your business has complex, multi-faceted inventory needs.

- Your long-time accountant will only work with QuickBooks.

- You require extremely detailed, granular financial reporting.

Xero is a fantastic choice for most modern small businesses. It proves that powerful software doesn’t have to be complicated. If you value simplicity, collaboration, and design, Xero deserves a top spot on your shortlist.